A Cheque Bounce Case is a common legal issue in India that arises when a bank rejects a cheque due to insufficient funds or other valid reasons. Many people face financial loss because of bounced cheques. Therefore, the law provides strong protection to cheque holders under Section 138 of the Negotiable Instruments Act.

Moreover, this legal provision helps maintain trust in business transactions. Understanding this process allows individuals and businesses to take timely legal action and recover their money legally.

1.What Is a Cheque Bounce Case?

A Cheque Bounce Case occurs when a person issues a cheque and the bank returns it unpaid. This usually happens when the account holder does not maintain enough balance or provides incorrect details.

However, the law does not treat every cheque bounce as a crime. The complainant must follow a legal procedure before approaching the court. The main purpose of this law is to promote honesty in financial transactions and protect the payee’s interest.

For professional legal support, you can visit Advocate Nexzen Power Legal Services (Internal Link) to get expert assistance.

2.Common Reasons for Cheque Bounce Case

Several reasons can lead to this Case. The most frequent causes include:

• Insufficient bank balance

• Account closed by the drawer

• Signature mismatch

• Cheque validity expired

• Overwriting on cheque

• Stop payment instruction

Moreover, technical banking errors may also cause cheque rejection. Therefore, checking the return memo carefully is always important.

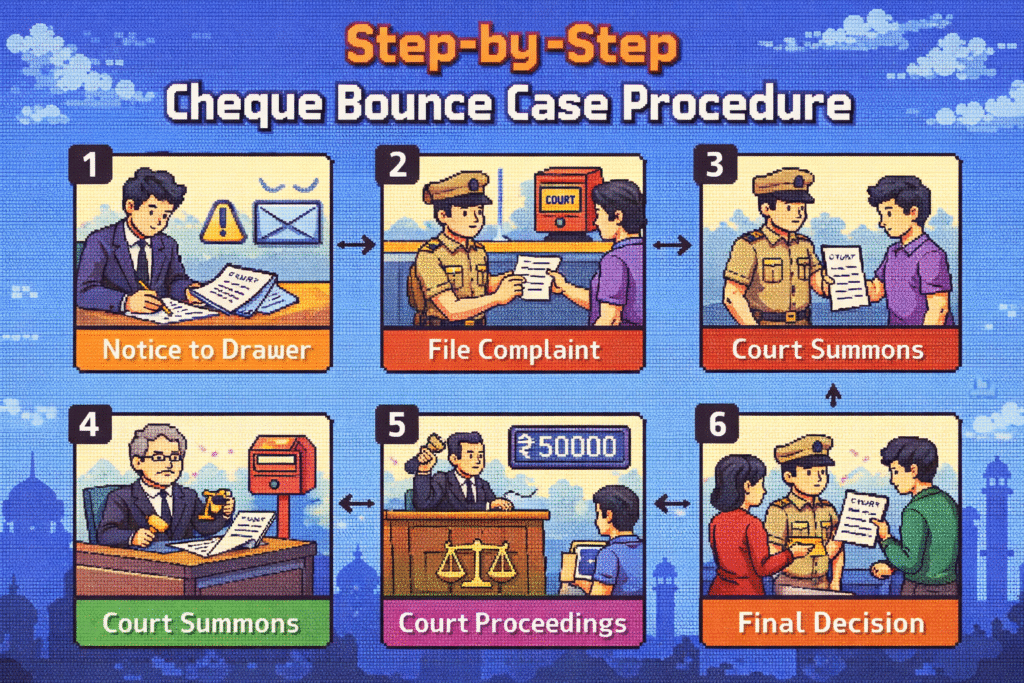

3.Step-by-Step Procedure

The Cheque Bounce Case follows a fixed legal process under Indian law:

• Bank returns cheque with return memo

• Payee sends legal notice within 30 days

• Drawer gets 15 days to make payment

• Complaint filing in court if payment fails

• Court issues summons

• Trial and judgment

As a result, following the correct timeline increases the chances of successful recovery.

4.Legal Notice in Cheque Bounce Case

A legal notice is a compulsory step in a Cheque Bounce Case. It informs the cheque issuer about dishonor and demands payment within the legal time limit.

The notice must include:

• Cheque number and date

• Amount to be paid

• Reason for bounce

• Payment deadline

Moreover, proper drafting of notice strengthens your legal position in court.

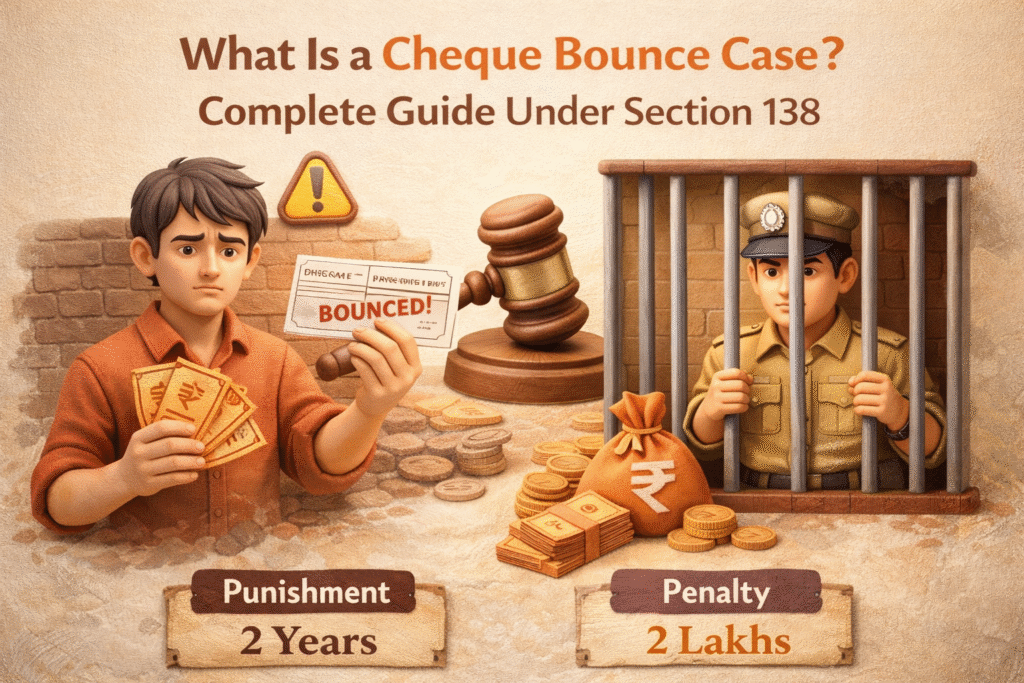

5.Punishment and Penalty in Cheque Bounce Case

If the court proves guilt in a Cheque Bounce Case, the accused may face the following punishment:

• Imprisonment up to 2 years

• Fine up to double the cheque amount

• Both imprisonment and fine

However, courts usually encourage settlement and compensation. Therefore, early payment and compromise can help avoid long legal battles.

Importance of Legal Support in Cheque Bounce Case

Legal guidance plays a major role in a Cheque Bounce Case. An experienced advocate ensures timely notice delivery, correct documentation, and effective court representation.

At Advocate Nexzen Power, we provide reliable legal services for cheque bounce recovery, legal notices, and court cases. Our team focuses on fast solutions and strong legal protection for clients.

Conclusion:

A Cheque Bounce Case protects financial discipline and business credibility. Understanding the procedure, deadlines, and legal consequences helps people avoid serious trouble and financial loss.

Therefore, if you face cheque bounce issues, consulting a qualified advocate and taking immediate legal action ensures better recovery and legal safety.For official legal provisions, refer to:

Negotiable Instruments Act, 1881 – Government of India